Seems only fair that we should acknowledge this auspicious date in some way, and while I don’t plan to get married (dread thought) on this day, it is worth pointing out that we won’t be getting a similar date for another thousand and one years or so, and then only if we add a thirteenth month. So make the most of it. So this post is going to be about numbers. Lot’s of them.

But I did want to make the most of a follow up to Erentz’s post on the affordability of housing – or not. It is an interesting challenge – how to get a house – and land – for under $300,000. Because, apparently, $300k means it is affordable. Putting aside for a minute the question of whether a $300k house is actually affordable by the average person (not couple – just a single person), if we also put aside the price of land, then some figures come forth:

Cheap build cost of $1500/m2 x typical average house size nowadays of 200m2 = $300k : but with no land. So that formula is not going to work. That means: standard suburban models are simply not going to work – ever.

Whereas that same cheap build cost ($1500/m2) x something half the size (ie 100m2 house) = $150k : ie leaves you $150k to buy the land. Which sounds good, except that even that is difficult to find in Wellington or Auckland. A section in Wellington seems to be averaging about $200k to $300k at present – but that is for a section size of about 450m2. That implies a land cost of $440 to $660 / m2 for a section alone. Let’s call it $500/m2 for simplicity sake.

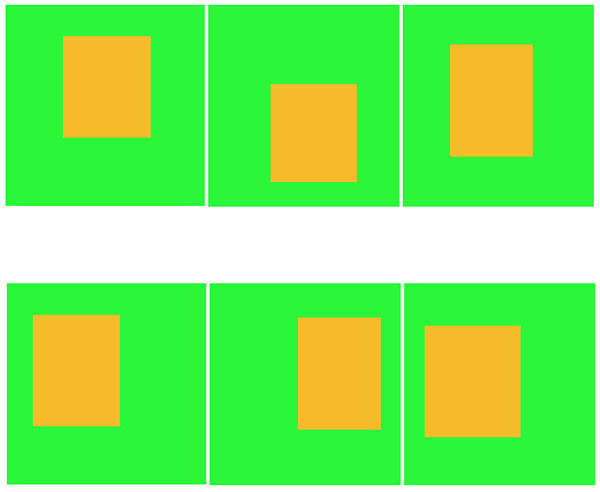

So – there is a very simple result here: reduce the size of the section. Instead of having a section size of 450m2, with a house size of 100-200m2 on it, and 250-350 of relatively wasted external space, what if there was a section size of just 150m2, for a house of 100m2. Will that work? Well, yes. Assuming the same cost of land, for a section size of 150m2 the land cost would only be $75,000. That leaves, say, $225,000 for the dwelling, which is good, as no-one wants to live in a small house that is built at the cheapest end of the market.

100m2 is not a small size really – it is a good two-bedroom home size, or a tight three-bedroom home if it is well designed. In reality, those monster, ugly, suburban homes with mandatory indoor parking for two or more cars, are a complete waste of money. And space. And life.

I think that we all know that a house built at a $1,500/m2 rate is going to be pretty damn god-awful. A slightly higher rate of $1,750/m2 rate is a more typical mass-builder rate, while a decent architecturally designed house is going to be more like $2,500/m2. And for your $225,000 lump o’ cash for your house, that’s going to get you just on 90m2 of prime, well-designed house.

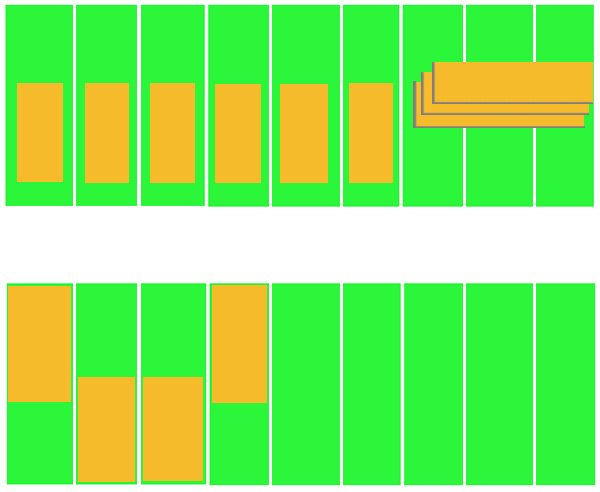

So, there is only one way we are going to get more out of this equation, and that is if we go upwards: multi-unit residential. Now then, I know that hardly any of these are getting built nowadays, what with the whole leaky and shaky issues going on, but I think we have to face it – it is the only way to go. Three stories high is the limit of timber framed construction according to NZS 3604, and yet four stories is the limit according to what people are prepared to walk up without a lift, so if you want to go further, you’ll probably have to go to concrete construction, and that is going to put you far higher in the $/m2 range. So, if we stick to three stories at present, and therefore split the land cost down into thirds, then our section size of 150m2 is only going to be $25,000. Now you’re talking! And there is still a 50m2 outside space to be shared amongst the three dwellings – or pooled, for a communal garden.

So, on the back of this swift calculation, what the government needs to be doing is saying to devlopers – no more monster bloated 200-300m2 houses with garages and bedrooms in excess, on wasted land in the suburbs – instead, let’s redevelop some older inner-city land in an intensive way, and build well-designed 90-100m2 units, three high, and sell them off to young people as starter homes. They’ll be affordable at $300,000 each.

Or will they?

By a couple, earning two average salaries at $800/week each (ie $41,600 each), that $300k mortgage is going to cost $480/week over 20 years at our current, very low floating rates. Yes, that is affordable – for a couple. For ye poor old average single person however, they’re stiff out of luck. There’s no chance of a single body on an average salary being allowed to spend over half their salary on mortgage: so if you are a single person, earning average, you are, quite simply, stuffed. Your only answer is to shack on up, share a bedroom, or keep on renting. Or move to Shannon.

Which is a fairly grim outlook.

what about 5-10 story high dwellings? How does that work?

Fear not, it’ll be 01/01/2101 again in 89 years.

What do you think about the Nouvo apartments planned by the Basin Reserve (http://nouvo.co.nz)? I’ve been eyeing them up as a single person income with two cats who like to go outdoors…

Joanna – I’ve been meaning to write a post on Nouvo since the day it popped its head up behind the fence at the Basin – but to be honest, it depresses the heck out of me. They’re in a fantastic location – views all around if you buy one on the front – no views at all if you’re in the townhouses down the back.

But it is the size, and the sameness of it all – i scale the apartments off at about 6m x 7m in size (so, 42m2 each), and at $310,000 each, that is $7,380/m2. You can see why they use the phrase “Developer’s Margin” on that. That cost is partially because it will need to be a really solidly built construction – steel and concrete with a single lift – and near the boggy soil of the old Basin. Deep piles I presume. What is odd is that they are all 1-bed apartments – even on the top floor, which I find really strange – no larger penthouse apartments with even a lavish 2-bed layout here, no, just 1-bed everywhere. It’s a development absolutely made for sad-cricket-watching men, and cat-owning-single women everywhere. The Nouvo website says that if you can stump up with a 20% deposit, you will be able to repay on the average wage of $42,000 per year, at about $350/week mortgage.

So – at 42m2, the size is about right for a single bedroom apartment, and the quoted price seems tasty. If you’re a couple, or your cats pay rent, you’re home and hosed. But there will be substantial extras. Body Corporate fees for example, are not quoted, and generally in Wellington they are going quite a bit higher than they used to, because of the insurance premiums now. Just don’t let your cats get outside and cross the road…

Harry – how does it work? – see the answer to Joanna above. Smaller, and way more expensive per square metre. But a more solid building, of longer lasting materials.