Pride commeth before a fall, as the old saying goes, but there’s normally something else that happens before the stock-market crashes, as we’re seeing at present. It seems that while the market gets busier and busier, more and more bullish, and developers develop balls of steel, that tall buildings are the things that truly commeth before a fall; that there is a direct link between ego and egg-on-face-oh. Since the age of the skyscraper, this has always been the way: with the Chrysler Building and the Empire State building culminating at the same time as the big New York stockmarket crash of 1929, the boom of the 80s with a wave of tall pomo buildings throughout Manhatten and around the world ending in the Crash of 1987, and the recent and ridiculous line-ups of tall tales of tall towers in the Middle East and the Far East, culminating in the present calamitous crash in stockmarkets around the world in 2008.

It’s all so predictable, and in theory so avoidable: if the market doesn’t get so swept up in itself, so carried away with the power of its own excesses, then we wouldn’t have the crazy booms, and wouldn’t have the crazy falls. Luckily for us in NZ, so we think, we rarely get that carried away. By and large we don’t have the crazy ego-maniacs building towers, and so in theory at least, we should avoid the catastrophic falls as well. Unfortunately, that one doesn’t seem to apply: we may not get the biggie ups, but we sure get the downside blues as bad as the next country anyway.

There’s another old adage, often stated, never proven, that there is a direct link between the state of the economy and the length of a woman’s mini-skirt.

Is there any truth in that, and if so, does it apply to Wellington? The theory is that as the economy booms and rises, so does the length of leg exposed below a skirt. The change in the 1920s from long flowing robes at the start of the decade, to daring above the knee fashions as the decade came to an end, coincided directly with the rise of the economy and the rise of the skyscraper. Come the Great Depression and then the Second World War, and hemlines became much more demure once more. Skirts shortened again in the 60s, only to lengthen again in the 70s, and rise again in the 80s shortly before the 87 Crash.

But what about this time? Are hemlines sky high? Is it possible to garner a gander by gender: to gauge the state of the world’s economy by casually eyeing the hem-length of a typical Wellington woman? My reaction is: of course not – there’s no such thing as a typical Wellington woman anyway, and besides, the wind is too great a factor to risk blowing up anyone’s skirt for them to be a feasible fashion indicator. The typical Wellington walk, it would seem, is to have one hand holding down the edge of your skirt – one wonders what women did in years past when they had to hold onto a hat with the other hand too. But of course, fashion (or the slavish following of it) is dead now anyway, as proclaimed on the cover of the latest 1am magazine. Christine Rankin seems to have been the last public figure to have brazenly gone forward into Lambton Quay with legs exposed, and yet she flew the coop some years ago now, spangly earrings and cleavage shining in the moonlight as she speed off down nowhere lane. However, as we move into November, and into summer, perhaps hem length is something that keen followers of the economy should be keeping a fisheye out for.

Was it just a coincidence that your post appeared the same day that this story appeared in the paper?:

http://www.stuff.co.nz/dominionpost/4740143a23955.html

“Hide those legs, teams told”

Glenbrae Marching Team and other masters teams were ordered by Marching NZ to wear trousers this marching season….

So the market crashes, and promptly next week the marching girls have to drop their short skirts and don trousers? Crickey, we must really be in for a bad recession !

No coincidence, just remarkable prescience….

I don’t know about miniskirts, but hotpants and short-shorts were in vogue last summer…

I reckon the micro-minis of the earlyish 2000’s would count. I remember them fondly.

“hotpants and short-shorts were in vogue last summer…” – that must have been the sign to sell out of the market then. There was a small dip in 2001 as well – obviously Alex’s micro-minis weren’t short enough. If only all economic theory was that easy to follow, and enjoyable to look out for….

Assuming therefore that the next big fashion thing will be a floor length skirt heralding the depth of the coming recession / depression, coupled with a proposal for a ground level building instead of a skyscraper, we should have this economic forecasting fixed.

actually, thinking about it, i spotted David Freak of Freak Productions wearing a full length skirt in Cuba Street last week.

I’m not sure that counts though.

getting off the ‘hot’ subject of short skirts – just for a minute – perhaps you need to have a look at this:

http://www.fahad.com/2008/09/dubai-city-tower-proposal-for-24km-high.html

Now – that link is somewhat misleading – its only for a 2.4 km high tower, not 24 km high, but that’s still quite tall:

“Dubai City Tower (also called ‘Vertical City’) is an architect’s proposal that began circulating in emails and at a skyscraper forum published in August 25th, but its origins are yet to be determined.

The professional project pitch details 400 habitable stories, topped by a 400m energy-producing spire, making it 2.4km high. The tower is proposed to be sited along the Arabian Gulf where part of the building could push into the ocean creating a marina and a destination for cruise ships and tourism. The proposed tower is organized into four 100 story “neighborhoods” connected via a vertical bullet train that quickly distributes people between Sky Plazas that separate the different vertical neighborhoods.

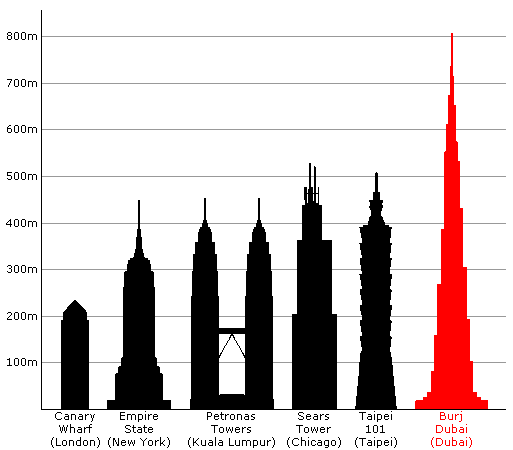

By comparison, Emaar’s Burj Dubai is largely predicted to be around 800m high and 160 floors.”

Another site is more informative about Dubai in general, including some more of those totally crazy schemes proposed / under construction at present?:

http://www.realtyna.com/dubai_real_estate/dubai-future-projects.html

when you look at it from a sane distance, its no wonder that world is in financial turmoil: and if your theory is right, Dubai must be due for a massive financial melt-down all of itself…

I think that when you look at the overall height of the Empire State Building and the Chrysler Building on the graph you show, compared to the behemoths of the last few years, you can see that they were amazingly tall and graceful structures – far more so than the Taipei 101 and Petronas Towers. They must have been so incredibly ground-breaking at the time.

Speaking of ground-breaking: there are reports that the concentration of load caused by the Burj Dubai has potential to cause local area earthquakes in the earth’s crust – structures like the 3 Gorges Dam in China have already been having that effect as well.

Possibly a good reason we don’t try to do the same along Lambton Quay, seeing as the crust is a wee bit shaky there already…..

from the Aussie paper today:

http://www.theage.com.au/national/architect-canaries-laid-off-20081031-5fka.html

“Architect ‘canaries’ laid off

Ben Schneiders

November 1, 2008

BIG architecture firms, regarded as the building industry’s “canary in the coalmine”, have started shedding staff rapidly. One source put the Melbourne job losses at more than 100, with such firms as John Wardle, Hassell, Bates Smart, ARM and Hayball all believed to have made cuts.

Smaller firms have also been letting people go. One senior architect, who asked not to be named, said the cuts followed a slowdown, where clients deferred major projects. Architecture was “very sensitive” to economic conditions, he said, as an expansion or new project was one of the first things that households or big firms shelved.”

and just in from the BBC: http://news.bbc.co.uk/2/hi/europe/7742538.stm

“Moscow super skyscraper halted

The Russian company building Europe’s tallest building has halted work on the project, citing the global financial crisis. The Norman Foster-designed Russia Tower being built in Moscow’s new central business district by developer Russian Land would be 600m (1,970ft) high.

Company head Shalva Chiriginsky said that work was being halted because of the credit crunch.

Norman Foster and Partners told the BBC it had not been informed of the freeze.

The tower was due to be completed by 2012 as part of the new business district dubbed Moscow City. Building work started in September 2007.

It would have 118 floors with housed offices, a five-star hotel and residential apartments.

Moscow is already home to the tallest building in Europe, the 268-metre Naberezhnaya Tower.

Announcing that there were also difficulties with another of the company’s big Moscow projects, the reconstruction of the Russia Hotel, Mr Chiriginsky said his company was having to cut its workforce.

He told Interfax, one of Russia’s most trusted news agencies, that Russian Land projects had “suffered” from being directed at the “super-luxury” segment of the market.

“Our problem is that we cannot carry out these projects in the current economic situation and given the current state of financial institutions in the country and abroad,” he said.

“The interest rate is high and there are no credit resources.”

Nobody at Russian Land was available to speak to the BBC on Friday.

Asked about Mr Chiriginsky’s comments, a Norman Foster Partners spokesperson in London replied: “We haven’t received any instruction about the project being on hold.”

the Dompost today has an article on something similar to this – not your hemline indicator, but something similar:

“First there was the McDonald’s theory of international relations; now there is the Starbucks recession indicator. The theory, first expounded in Slate.com, goes something like this: countries with high numbers of United States coffee chain Starbucks outlets are more likely to have suffered financial meltdowns because the outlets are an indicator of connections to the damaged American financial system.”

“The US, Britain and Australia have suffered from the credit crunch, while those without the coffee chain, such as Argentina, Brazil and Italy, have remained largely untouched. New Zealand is well-off for Starbucks, with 42 for a population of four million. If the theory has any validity, it follows that New Zealand’s recession, which officially started in September, will be a bad one.”

http://www.stuff.co.nz/dominionpost/4776491a6034.html

— mind you, Wellington itself doesn’t have too many Starbux does it? I only know of one in Welly – at the bottom of the Majestic Tower, and its always looking deserted.